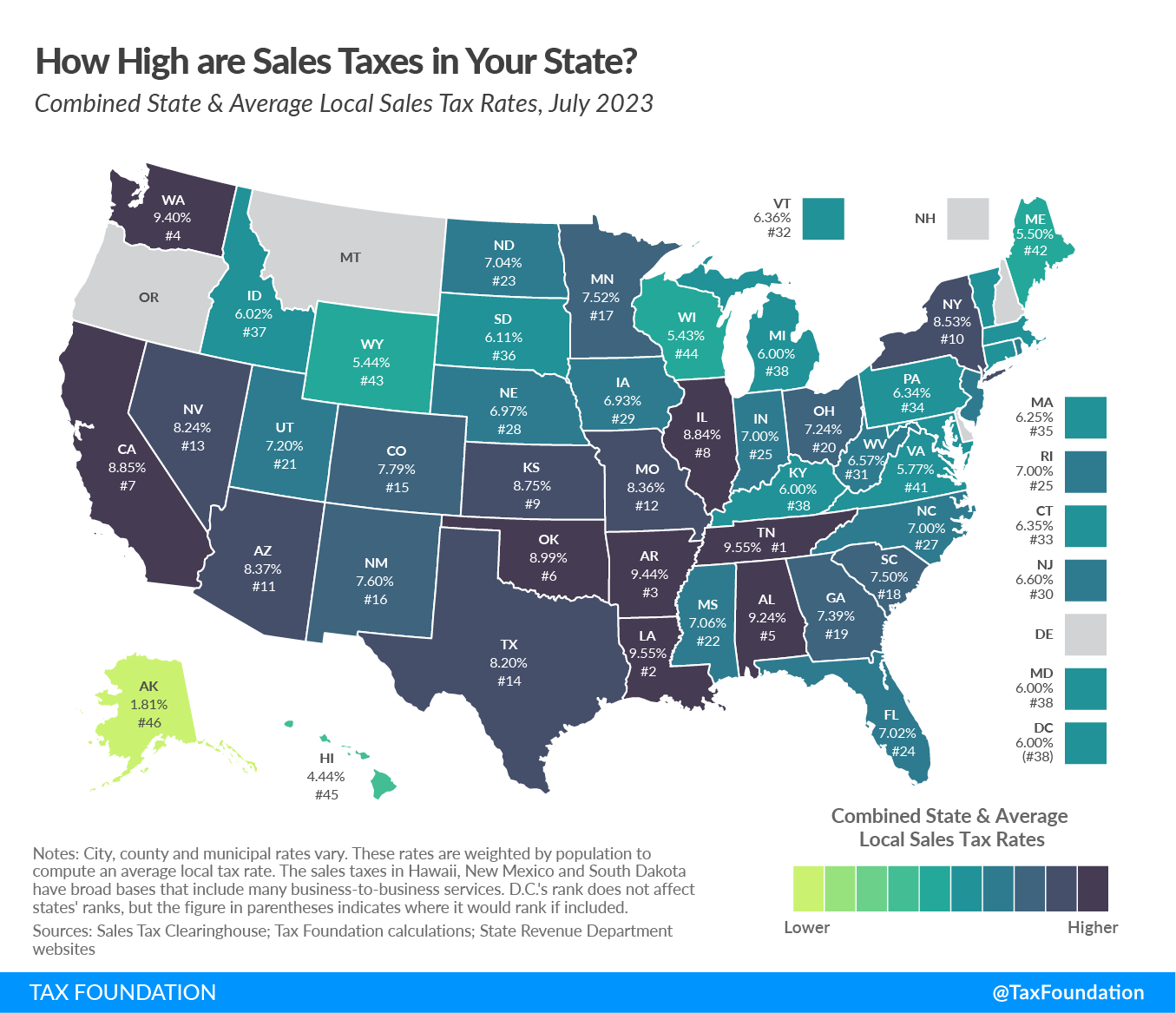

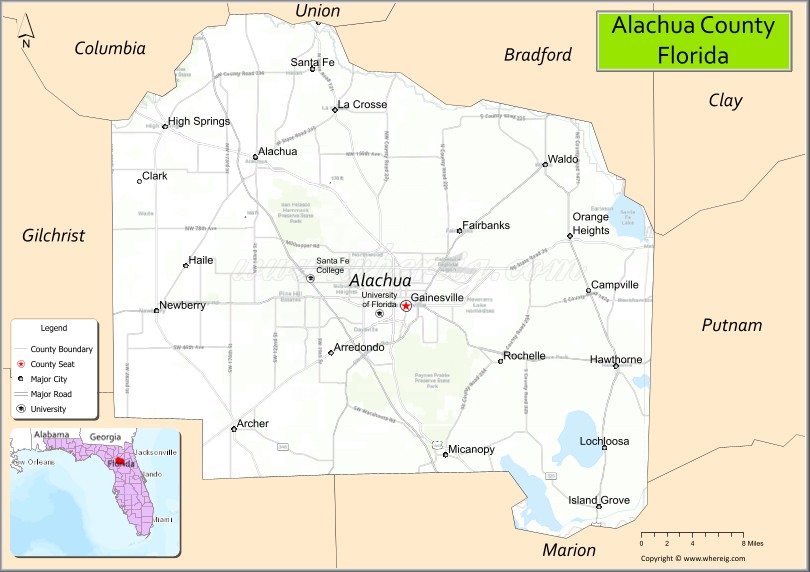

Alachua County Sales Tax 2025. Beginning january 1, 2023, the combined florida state and local sales and use tax rate for alachua county is 7.5%. This rate includes any state, county, city, and local sales taxes.

Approval of ordinance voters approved an alachua county board of. It gives you taxable amount, tax and total amount in alachua county.

Alachua County Sales Tax 2025 Images References :

Source: www.gainesville.com

Source: www.gainesville.com

Alachua County to decide sales tax increase for 10 years in election, This figure is the sum of the rates together on the state, county, city, and special levels.

Source: mycbs4.com

Source: mycbs4.com

Alachua County voters change how Commissioners get elected and approve, 2020 rates included for use while preparing your income tax deduction.

Source: maryclarkson.pages.dev

Source: maryclarkson.pages.dev

Sales Tax Calculator 2025 Arkansas Mary Clarkson, Click any locality for a full breakdown of local property taxes, or visit our florida sales tax calculator to lookup local.

Source: www.acftechnologies.com

Source: www.acftechnologies.com

Alachua County Tax, It gives you taxable amount, tax and total amount in alachua county.

Source: www.gainesville.com

Source: www.gainesville.com

Alachua infrastructure sales tax floated for rural road safety, This rate includes any state, county, city, and local sales taxes.

Source: carlmorgan.pages.dev

Source: carlmorgan.pages.dev

Sales Tax Rate In Ohio 2025 Carl, The florida sales tax rate is currently 6.0%.

Source: 2collegebrothers.com

Source: 2collegebrothers.com

Alachua County Property Tax 💰 Gainesville Property Tax Guide & Paying, Tax rates provided by avalara are updated regularly.

Source: venusymaribeth.pages.dev

Source: venusymaribeth.pages.dev

Alachua County Calendar 2025 Tarra Francine, Your total sales tax rate combines the florida state tax (6.00%) and the alachua county sales tax (1.50%).

Source: anettebkikelia.pages.dev

Source: anettebkikelia.pages.dev

Tax Calendar For 2025 Deanne Viviene, Calculate alachua sales tax easily with the sales tax calculator.

Source: alachuacounty.us

Source: alachuacounty.us

Alachua County Forever Expands Lake Alto Preserve, There is no applicable city tax or special tax.

Posted in 2025