Tax Rate Married Filing Jointly 2024. For example, in 2019, a married couple filing jointly with a household income of $600,000 would have been taxed at a top tax rate of 37%. Married couples filing a single joint return together.

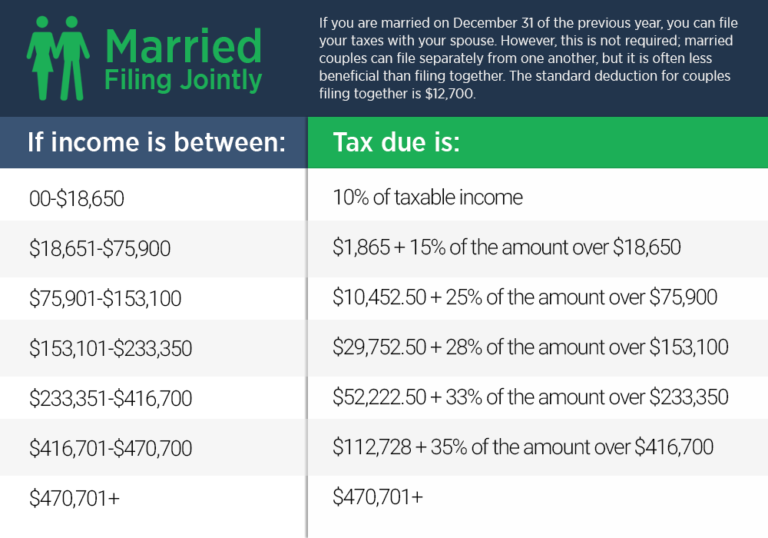

Tax rate single filers married filing jointly or qualifying surviving spouse married filing separately head of household; Married couples who each file a separate tax return.

You Earn A Capital Gain When You Sell An Investment Or An Asset For A Profit.

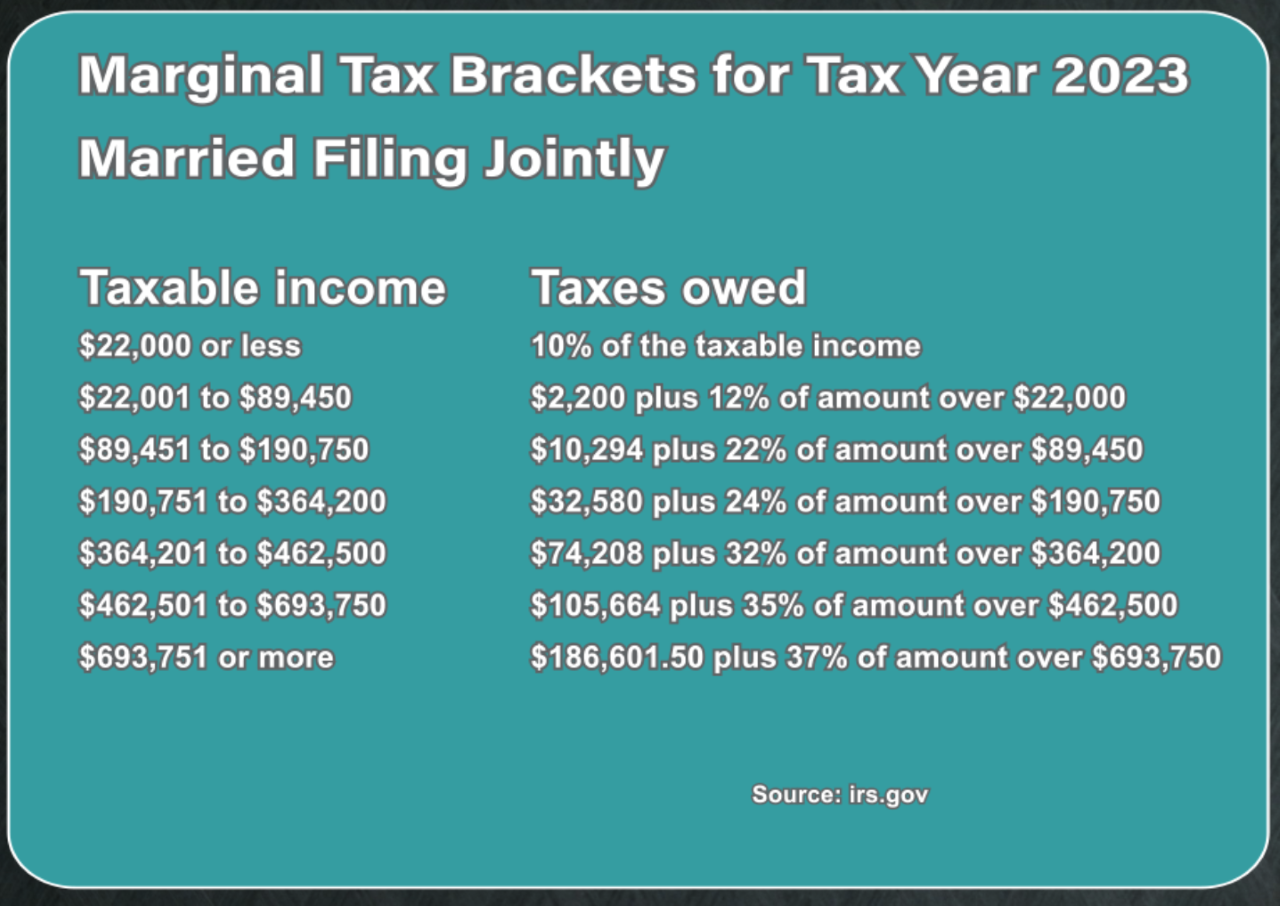

Married couples filing jointly are taxed at the 10% rate on their first $22,000 in income during the 2023 tax year, increasing to $23,200 for 2024.

Tax Deadlines (As Of November 2023) Jan.

What is “married filing jointly”?

The Internal Revenue Service (Irs) Has Designated Seven Federal Tax Brackets That Apply To Both The 2023 Tax Year (The Taxes You File In April 2024) And The.

Images References :

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Additional 3.8% federal net investment income (nii) tax. The standard deduction gets adjusted regularly for inflation.

Source: www.youtube.com

Source: www.youtube.com

How to fill out IRS Form W4 Married Filing Jointly 2022 YouTube, Is filing taxes separately when you're married a good idea? How income taxes are calculated.

Source: www.bluechippartners.com

Source: www.bluechippartners.com

What Is My Tax Bracket 2022 Blue Chip Partners, The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2023 tax year (the taxes you file in april 2024) and the. Income phaseouts begin at magi of:

Source: hopevirals.blogspot.com

Source: hopevirals.blogspot.com

Married Filing Jointly Tax Brackets 2022 2022 Hope, Tax rate single filers married filing jointly or qualifying surviving spouse married filing separately head of household; Person 1 (husband) earned income.

Source: e.tpg-web.com

Source: e.tpg-web.com

Anh Le's Tax Planning Guide 2022 Tax Planning Guide Brackets and Rates, Married filing jointly or qualifying surviving spouse. For 2024, the deduction is worth:

Source: oakharvestfg.com

Source: oakharvestfg.com

IRS Tax Brackets AND Standard Deductions Increased for 2023, Head of household income range:. For the latest information about developments related to pub.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

what are tax rates for married filing jointly Federal Withholding, The two figures are then combined to yield a total income tax of. Gifting can help reduce the value of your estate without using up your lifetime gift and estate tax exemption.

Source: www.hackbus.info

Source: www.hackbus.info

2022 Tax Brackets Irs Married Filing Jointly dfackldu, First, we calculate your adjusted gross income (agi) by taking your total household income and reducing it by certain items. The excess income ($35,000 minus $11,600, or $23,400) will be taxed at 12%, yielding $2,808.

Source: crossborderplanner.com

Source: crossborderplanner.com

The Ultimate Tax Guide How the USA taxes married couples, Married couples filing jointly are taxed at the 10% rate on their first $22,000 in income during the 2023 tax year, increasing to $23,200 for 2024. Tax rate single filers married filing jointly or qualifying surviving spouse married filing separately head of household;

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png) Source: projectopenletter.com

Source: projectopenletter.com

2022 Tax Tables Married Filing Jointly Printable Form, Templates and, The excess income ($35,000 minus $11,600, or $23,400) will be taxed at 12%, yielding $2,808. Has business or self employment.

2024 Tax Rates, Schedules &Amp; Contribution Limits.

Here's how those break out by filing status:

Tax Deadlines (As Of November 2023) Jan.

Rate married filing jointly single individual head of household married filing separately;